The ask is the price at which you can buy the base currency. Typical spreads may not be available for managed accounts and accounts referred by an introducing broker.

Forex Spreads Trading Strategies Tips Trading Tips Zone

Forex Spreads Trading Strategies Tips Trading Tips Zone

Extreme deals both too small and too big are quoted with broader spreads due to risks involved.

Forex pairs spread. Costs are based on forex spreads and lo! t sizes. The spread is how no commission brokers make their money. Middle size spot deals are executed on quotations with standard tight spreads.

Forex brokers quote two different prices for currency pairs. Forex spreads explain ed. Spreads will vary based on market conditions including volatility available liquidity and other factors.

The forex spread represents two prices. Next factor is amount of a deal. And the spread in forex is the price difference between the bid price bid and the selling price ask offer of the rate of the currency pair posted when performing forex trading.

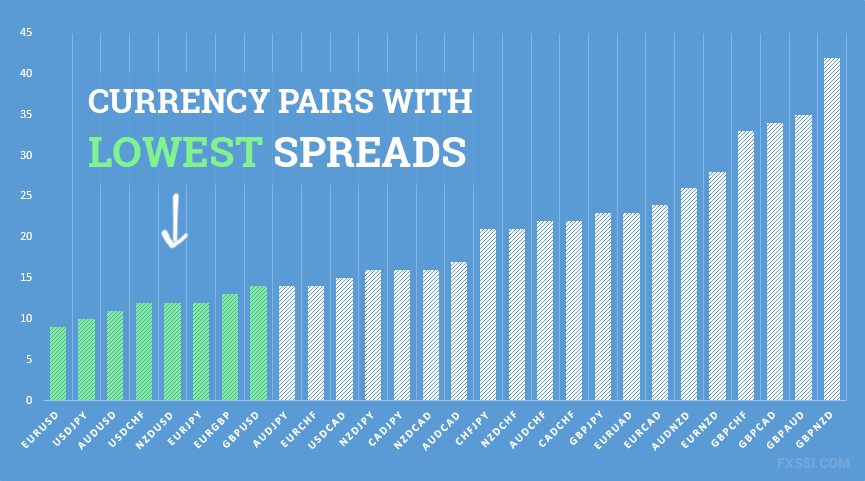

Popular currency pairs are traded with lowest spreads while rare pairs raise dozen pips spread. Main t alking points. Spreads play a significant factor in profitable forex trading.

When we compare the average spread to the average daily movement many interesting issues arise. Spread means spreading widening pri! ce range net amount. The bid and ask price.

! The pair is seeing a tightrope act today amid conflicting market cues. Spreads are based on the buy and sell price of a currency pair. The buying bid price for a given currency pair and the selling ask price.

In forex the spread is essentially one part of the cost for you as a trader to open any trades. The bid is the price at which you can sell the base currency. Traders pay a certain price to buy the currency and have to sell it for less if they want to sell back it right away.

Forex trading is all about buying and selling currencies in pairs some more profitable than others. Sell off in forex market and us greenback own safe haven image from recent past continue to support usd in risk averse scenario. Here we look at some of the best currency pairs to trade.

It counts into the total price of trading. The difference between these two prices is known as the spread. First some pairs are more.

!Metatrader spreads may vary. For example if the rate in us dollar yen is 10115 20 the spread is 5 sen. As in life the price for common things is lower compared to other more exotic and in demand.

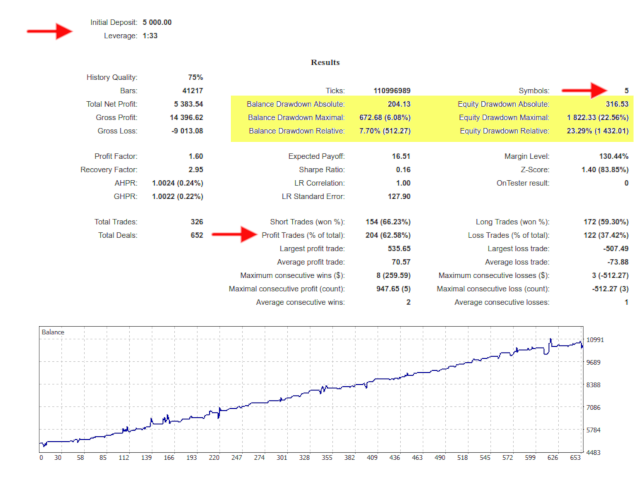

Buy The Multicurrency Spread Trend Ea Trading Robot Expert

Buy The Multicurrency Spread Trend Ea Trading Robot Expert

Top 5 High Spread Currency Pair Forex Basics Tutorial In Urdu And Hindi By Tani Forex

Top 5 High Spread Currency Pair Forex Basics Tutorial In Urdu And Hindi By Tani Forex

What Are The Best Currency Pairs To Trade In 2019

What Are The Best Currency Pairs To Trade In 2019

Forex Lowest Spread Pairs Lowest Forex Spreads

.png) Currency Pair Correlations Forex Trading Octafx

Currency Pair Correlations Forex Trading Octafx

What Does A Forex Spread Tell Traders

What Does A Forex Spread Tell Traders

Axitrader Review Forexbrokers Com

Axitrader Review Forexbrokers Com

Currency Pair Correlations Forex Trading Octafx

Currency Pair Correlations Forex Trading Octafx

Low Spread Currency Pairs To Trade On Forex Market Today Fxssi

Low Spread Currency Pairs To Trade On Forex Market Today Fxssi

Why Are Spreads Wider In Some Stocks And Forex Pairs Compared To Others

Why Are Spreads Wider In Some Stocks And Forex Pairs Compared To Others

Forex Lowest Spread Pairs Lowest Forex Spreads

Why You Should Use Low Spread Scalping Strategies

Why You Should Use Low Spread Scalping Strategies

Why You Should Use Low Spread Scalping Strategies

Why You Should Use Low Spread Scalping Strategies

How To Trade A Synthetic Currency Pair And Why You Probably Shouldn

How To Trade A Synthetic Currency Pair And Why You Probably Shouldn

0 Response to "Forex Pairs Spread"

Posting Komentar